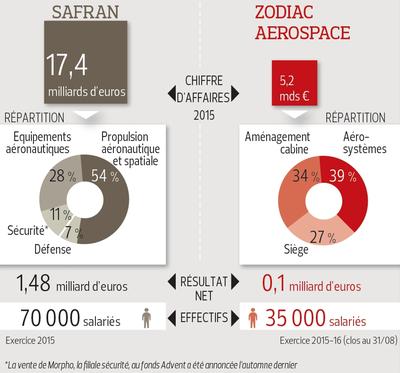

INFO LE FIGARO – After a first failed attempt, Saffron launches a friendly TAKEOVER bid of nearly 10 billion euros on the French specialist of the airline seats, in trouble. The merger of the two groups gives birth to a giant 21 billion euros of sales.

After the merger, giant Essilor-Luxottica, the aeronautical between to turn her into the prom of mergers and acquisitions, the year 2017. According to our information, the engine manufacturer Safran announced on Thursday 18 January, the purchase of Zodiac Aerospace for nearly € 10 billion (with assumption of debt). Approved by the supervisory board of Zodiac on Wednesday evening, the operation is friendly. It takes the form of a public purchase offer (OPA), which enhances the specialist of airline seats to 8.3 billion, against 6,77 billion in market capitalisation on Wednesday.

The shareholders of Zodiac, which was convened Thursday in a general assembly at Port-Marly (Yvelines), to be offered 29,50 euros per share, against 23,35 € yesterday on the stock Exchange. It is expected that the family shareholders, to the first row in which the Domange and Marechal, who bring their titles (a third of the share capital) Saffron, which will merge with Zodiac. At the end of the operation, the family shareholders and the Fonds stratégique de participation (FSP) and the FFP, the investment company of the Peugeot group, will own 10 % of the share capital, provided that the State, which applauds this approximation. The balance, consisting of the free float, shares held by employees and treasury shares, will represent approximately 80% of the capital of the new set.

In marrying, Safran and Zodiac give birth to a group of 21 billion turnover business with 90,000 employees and global leadership positions in all its businesses. The new group kept the name of Saffron. The Zodiac is preserved as a trademark. The governance of Saffron, enriched by Zodiac, remains in place with Ross McInnes to the chairman of the board, and Philippe Petitcolin to the general management. Olivier Zarrouati, chairman of the management board of the Zodiac, takes the post of deputy general manager.

In eighteen months, Philippe Petitcolin was given a huge boost to Saffron

The transaction enables Safran to balance its activity between the propulsion and aircraft equipment. It becomes the world leader of the cabin, the floor-to-ceiling, seats of aircraft and systems security (slides for evacuation, pressurization, etc.). Safran is also a player in the complete energy sector jobs, and positions itself as a leader in the aircraft’s all-electric. It is now present in all the sectors, from energy generation to distribution through the wiring. The activity of the two companies is very complementary. According to our information, Safran will retain all of the activities of Zodiac and its factories in France.

In eighteen months, Philippe Petitcolin was given a huge boost to Saffron. Determined and pragmatic, and it has led to the legacy of his predecessor. It has completed the sale of Morpho, a subsidiary security, diversification desired by Jean-Paul Herteman, CEO until may 2015. With Zodiac, the leader of a successful operation that Saffron had missed… in 2010. “The first attempt was aggressive. It had been initiated in the back of the management. The method has changed, a climate of confidence is created. The project allows everyone to find its place,” says one very good source.

Click here to enlarge the infographic

Click here to enlarge the infographicSustainability

discussions are underway in the fall of 2015, after first dinner between Ross McInnes and Olivier Zarrouati. Then a meeting between Didier Domange, chairman of the supervisory board of Zodiac, and Philippe Petitcolin. These are the four men the keys of the deal. At the same time, the banks advice – Lazard and Bank of America Merrill Lynch for Saffron ; Rothschild and BNP Paribas for Zodiac – worked on the purchase of “Guizot,” by “Rueff”, the code names of the two companies.

once the sale of Morpho buckled, the relations have intensified. Didier Domange, the more attached to the independence of Zodiac among the family shareholders bound by a pact of self-defence, acquires a belief. It is better to ensure the sustainability of the activities of the Zodiac among a group of financially strong and technically competent, which the family will become a shareholder, risking the collapse or takeover by a foreign group.

The u.s. is UTC in ambush. Rockwell has acquired, in October 2016, BE/Aerospace, a competitor of Zodiac. These movements respond to the desire of Airbus and Boeing, who want to work with strong partners.

Zodiac, which celebrated its 130th anniversary in 2016, has lost its luster. Since two years he is in the middle of a storm. Design defect, quality issue, congestion in the factories, disruption, delays in delivery… The company pays dearly for a policy of bold acquisitions in all directions, including in the United States, which propelled her to the first rank in the world. But the integration did not follow. Zodiac is a brotherhood of SMES to the methods and processes are different. Therefore, nine profit warnings in two years and the commitments, are not required, a return to normal, much to the chagrin of customers – Airbus has sharply rebuked Zodiac – and shareholders. Some, led by the society of alternative management Ciam, pointing to a governance ineffective because too much family and not professional enough. And questions the competence of the management.

rude Awakening

After the years of conquest under the leadership of its iconic boss, Jean-Louis Gérondeau, who died in November 2009, the wake-up is brutal for Olivier Zarrouati, his successor. Just appointed, he must fend off the first attack of Saffron. Then he is faced with the challenge of increasing production rates of Airbus and Boeing. While it is difficult to “feel” the legacy of Jean-Louis Gérondeau. But the industrial disaster has created conditions for an evolution of the position of the family shareholders.

“The administrators, as the management, have not seen the depth of the crisis, as Zodiac continued to win contracts. They were reluctant to drop the statue of the Commander”, analysis of a very close group. The transformation plan will Focus, launched here a year, does not yet have its fruits. Olivier Zarrouati was still three years before returning to the situation before the crisis. The recovery was to be conducted independently. Unless it was shown that a third party would do “better than us”, he blurted out, in November.

Saffron was able to convince. The group felt that Zodiac had not lost the confidence of its customers. And that, on the industrial side, it had hit the bottom and moving in the right direction to start. With its know-how in the field of integration, and its industrial skills, its armies of engineers, production and quality, Saffron is estimated that it will be better and faster.

No comments:

Post a Comment