The PS deputy of the Ardeche, Pascal Terrasse, calls Monday evening the Prime Minister a report in which it made 19 proposals for taxing the collaborative economy.

You know Laurent Grandguillaume the mediator to settle the dispute between taxis and bikes. Here Pascal Terrasse, another Socialist MP, which itself was commissioned by Prime Minister Manuel Valls to shed light on the collaborative economy. A sector that represents more than 15,000 companies (almost as much as VTC drivers in France) weighs about 2.5 billion in sales in France and generates 13,000 direct employees jobs. Behind the battle between taxis and bikes, a phenomenon disputed by some and supported by others: ubérisation. In its report it must make to the Prime Minister today, the Ardèche deputy nevertheless wishes to avoid amalgams “the collaborative economy, this is not the ubérisation,” he says in preamble. The collaborative economy is exactly ubérisation a component of which is also based on digital innovation and freelance work.

Like his colleague Grandguillaume must find ways to better manage the economy VTC platforms, Pascal Terrasse will also have successfully tightrope. It will take him at once, ensuring transparency in tax matters on digital platforms practices such as Airbnb, BlaBlaCar or Le Bon Coin, but without hindering the growth of 276 start-up of the sector that are active in France. “The collaborative economy is a credible alternative to a consumption model that runs out of steam,” he says, while demanding that his players “take responsibility”.

“the idea is not to knock the collaborative economy of administrative paperwork,”

the socialist deputy of the Ardeche was floored and prepared 19 proposals to better regulate the collaborative economy. Pascal Terrasse suggests that the platforms that have knowledge of the income generated by their users can communicate the amounts to social and tax administrations to ensure that income is not subject to any taxation. The report therefore calls for a “clarification” of the distinction between “income sharing costs and the social administration on the notion of occupation ‘. “The administration should explain that certain activities do not generate taxable income (such as carpooling) and that, when they exceed the amateur practice these activities require the user registers as a professional,” says Does -he.

Panorama active platforms in the collaborative economy. Source: PIPAME, July 2015

This measure was supposed to be included in the law Macron 2. But the project led by Emmanuel Macron will not see the day, and this proposal, and perhaps others of the report will eventually be integrated into the draft labor law championed by Myriam El Khomri. “I am one of the friends of Emmanuel Macron. We work a lot together, I think it is sometimes misunderstood. But he is right: society changes. Either we adapt to the digital revolution, we will be overwhelmed very quickly. ” This does not prevent Pascal Terrasse recalled that “the collaborative economy is not a lawless area.” While digital businesses are expected to capture a significant share of value creation, some implement of tax avoidance strategies.

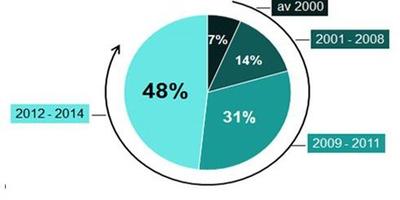

Distribution of platforms according to their creation date. Source: PIPAME, July 2015

The so called parliamentary government “to act so that these big foreign companies pay taxes in France”. “The idea is, however, not to knock them out administrative paperwork, he said Monday morning on Europe 1. But that is not because we earn money by renting their apartment or car that will be tax exempt. There are a number of franchises and dejection which the French must know the existence “. MP recommends a level between 2,000 and 3,000 euros when the Senate proposes to set the 5000 euros. From this amount, the activity would be considered as regular and therefore subject to tax. Conversely, anyone below this threshold would be exempt from any taxation.

“80% of online purchases are made from acts of ratings. It is known that 50% of the ratings are false “

In terms of transparency, including the MP wants the creation of a” scoring space platforms “and that the consumer has’ a clear, readable and accessible on the responsibilities of the platform, the quality of the supplier and the guarantees associated with their status. ” “80% of online purchases are made from acts of ratings. It is known that 50% of the ratings are false, “said Pascal Terrasse France Info radio Monday morning. Among other proposals, Pascal Terrasse evokes the creation of an “observatory” of the collaborative economy or to promote “collaborative experimental territories” to “develop local sharing tools goods and services across local, especially in rural areas. ” “I’m not here to make law, but merely proposals,” he said.

No comments:

Post a Comment