COMPUTER GRAPHICS – Listening to the executive pension plans are close to balance and require more structural reforms. But eventually restoring balance plans are among the most optimistic assumptions, with growth of 1.5% per year from 2020.

After the storm, thinning … the pension monitoring Committee, an organization created to ensure that the pension system meets the three objectives assigned by law Touraine 2014 (standard of living of pensioners, fairness between policyholders, sustainability financial), showed that Monday could not be more optimistic at the presentation of its third report to the Prime Minister. In its five members, “the situation and perspectives of the pension system does not depart significantly from the objectives set by the law.” A “slow but significant improvement” which confirms, according to Manuel Valls, “the very strong recovery of our pension system” that the left handed, through the reform of 2014, “on the road to sustainable financial balance.”

More lyrical, Marisol Touraine assures the French who doubt that “balance is back.” And the Minister of Social Affairs, always very political in his speech made, hammering that “the question of the age of retirement has no reason to be asked today” for financial reasons before castigated “those who want to distill bad news, those who want to play on anxieties, those in view of the forthcoming elections want to be the messengers of anxiety.” Understanding all candidates Republican primary …

“In favorable economic scenario, the system tends towards fiscal balance or surplus” presage the monitoring committee. If the situation does not deteriorate, the need for financing the system will be 0.2% of GDP in 2020, 4 billion. A deficit two times lower than qu’anticipait there a year the Board of the Pensions (COR). And significantly revised down today because of the agreement reached by the social partners in the fall of 2015, which aims to cut 6.1 billion euros in 2020, the need for funding plans complementary retirement.

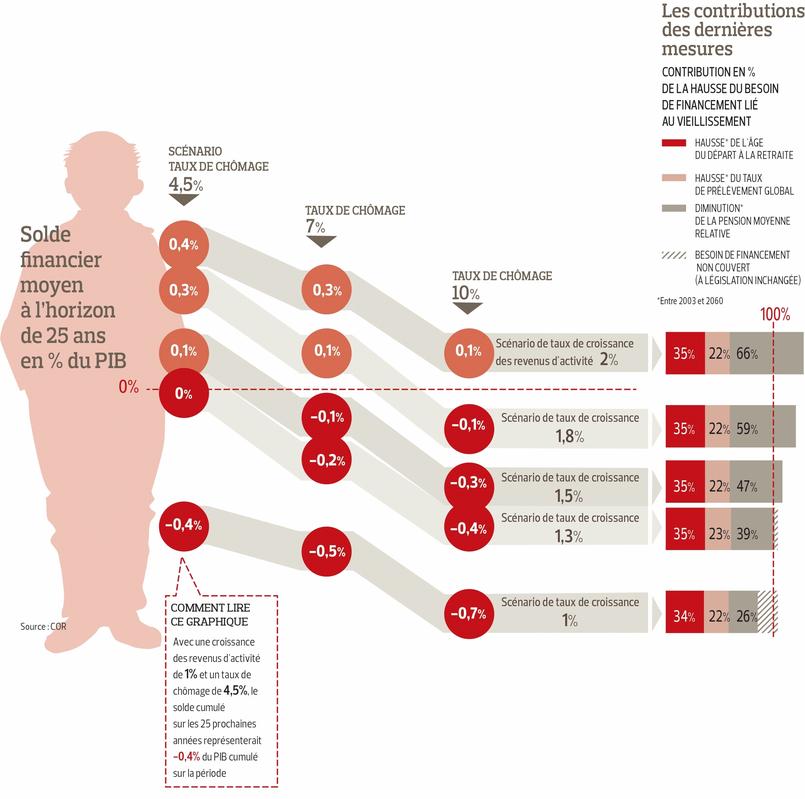

It is then that it thickens, potentially. From 2020, financial projections vary chosen paths. The median scenario whose assumptions (growth of 1.5% per year of labor productivity and unemployment rate of 7%) are called “reasonable and responsible” by Marisol Touraine, provides for a return to the green amidst the next decade. However, if growth stagnated at 1%, the pension system would show a deficit equivalent to 0.5% of GDP in 2040. An imbalance which then would necessitate further painful reforms: increasing contributions, lower pensions, rehabilitation the retirement age of retirement or the contribution period.

«La position represents a significant improvement compared to 1990 and fears that had aroused the crisis of 2008: the state has shown a good response, “however reassured the Chair of the Monitoring Committee, Yannick Moreau. Not without suggesting to the executive not to rest on its laurels and “now trying to be more proactive.” It calls for, including a reconciliation of calculation methods of the various schemes and harmonization of family benefits and survivors’ pensions, in order to make it more readable the equity effort between regimes.

former President of COR further recommends reviewing the indexation of pension rights in order to reduce the system sensitivity to changes in growth and thus cushion the financial shock in case of economic downturn. A reform that would also avoid, in case of strong growth for a decade, a sharper decrease than is expected today in the replacement rate (percentage of earned income retained by an employee its first year of retirement). Namely to increase the standard of living of pensioners in forty years, from 105% to 85% of assets.

Cliquez here to enlarge the graphic

No comments:

Post a Comment