INFO LE FIGARO – The Ministry of Finance plans to bring in 2017 the tax rate on SMEs alone company from 33.3% to 28%. . A first step in the movement promised to harmonize the tax on the European average

This is a track at which Bercy thought seriously: back the tax rate on companies (iS) in the average of the euro area for SMEs, 28%. A measure long demanded by enterprises today facially taxed at 33.3% for the vast majority of them.

The third part of the responsibility pact, which will appear in the draft Finance Act 2017 – which has allowed to give 41 billion euros of competitiveness to companies from 2013 to 2017 – began to take shape in the mind of the executive. In an interview in late June to Voices , Francois Hollande had already indicated its preference for an increase in competitiveness and employment tax credit (CICE) next year, rather than the originally envisaged scenario of suppression the last installment of the C3S (tax on sales) and a reduction of early corporate tax rates for all companies. To fulfill the promise of lower corporate levies of EUR 5 billion in 2017, the head of state had also announced plans to extend the measurement of investment overdamping while reducing specific samples to independent and artisans and making a gesture in favor of SMEs.

According to our information, Bercy wants this boost for SMEs will result in the creation of a corporation tax rate to 28%, that of the average of the euro area. “SMEs below a certain turnover threshold, to be defined, would be subject to IS 28%,” says one expert dossier. Approximately EUR 400 million would be spent on this measure.

“To bring the corporate tax rate to 28%, we have the choice to decline a little each year for all companies – with one point of IS cost 1.2 billion euros. Or you create a rate of 28% for SMEs, then gradually expanding the number of companies that can benefit from this lower rate, “says one at Bercy. It is the latter scenario that seems to have the preference of the Finance Minister Michel Sapin.

It would allow the executive to do two things at once: to support SMEs and improve the attractiveness of the country, beginning the movement of European tax harmonization through a targeted reduction in the rate of IS, but straightforward and readable. “We look at this track; it has the merit of giving the direction we want to go, namely a corporate tax rate to 28% for all companies horizon in 2020 “, confirms the Minister of Finance entourage.

In practice this new rate would be inserted in 2017 between the conventional rate of 33.3% and the reduced rate of tax to 15% – which may benefit, on their first 38,000 euros of profits, smaller companies that realize a maximum turnover of 7.6 million.

the alternative to this scenario would be to raise the ceilings or down the reduced CIT rate below 15%, to benefit more small enterprises ; but would have the disadvantage of limited to technical measurement threshold. The arbitration will take place, as every year, in late August. Whatever the form, SMEs will have their boost. The executive is however not yet convinced that it will be possible to make a new gesture for households next year given the low margins of budgetary maneuver.

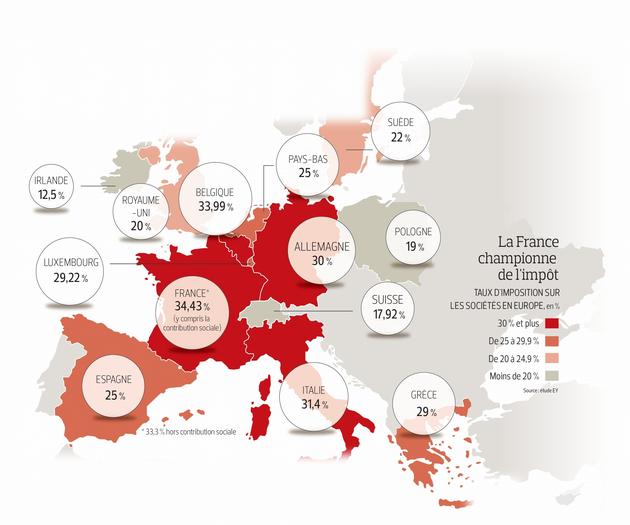

Cliquez here to enlarge the graphic

No comments:

Post a Comment